IPE D.A.CH: How has 2023 been for Asian stock markets in general?

Bihani: Asia ex Japan equities recorded a positive performance in the first quarter, with strong gains by Taiwan, Singapore and South Korea offsetting weaker performances by Hong Kong, India and Malaysia. Chinese shares achieved robust gains at the start of the quarter after Beijing loosened its Covid-19 restrictions that had constrained the country’s economic growth. Supportive property market measures and a loosening of the regulatory crackdown on China’s technology companies also bolstered investor sentiment. Coming into the second quarter of 2023, Asia ex Japan equities recorded a negative performance with China, Malaysia, and Thailand were the worst-performing index markets, while share prices in India, South Korea and Taiwan gained. Chinese equities were sharply lower in the second quarter as the economic rebound, following the country’s reopening after the Covid-19 crisis, started to cool. Factory output in China has started to slow due to lacklustre consumer spending and weak demand for exports following interest rate rises in the US and Europe. Hong Kong shares prices also fell in the quarter, as a cooling of the Chinese economy weakened sentiment towards Hong Kong stocks too. In the third quarter, Asia ex Japan equities declined. Most markets in the MSCI Asia ex Japan Index ended the quarter in negative territory as concerns over the Chinese economy and fears over global economic growth weakened investor sentiment. Hong Kong, Taiwan, and South Korea were the weakest index markets, while Malaysia and India achieved growth in the quarter. Chinese stocks experienced sharp declines in August, with the country’s property sector performing particularly badly as investors doubted that Beijing will deliver enough stimulus to put the world’s second-largest economy back on track. Although China’s official PMI manufacturing index rose in August it marked the fifth straight month of contraction as the reading remained below the 50-point threshold. China has sought to boost confidence in the country’s flagging stock market by cutting stamp duty levied on share transactions and slowing the pace of initial public offerings in Shanghai and Shenzhen, which can draw liquidity away from the wider market and weigh on share prices.

IPE D.A.CH: Fully aware that you do bottom-up stock picking. But has there been any countries and/or sectors where you find good value?

Bihani: Our process is bottom up and as such the sector and country positions are a result of where we find stock specific value opportunities. Today we see those clusters of attractively valued stocks represented by an overweight in China and Indonesia and across sectors such as Financials and Consumer Discretionary.

IPE D.A.CH: Your obviously one of the few ‘value’ managers in Asia, where many run a more blended approach. What is the reason behind?

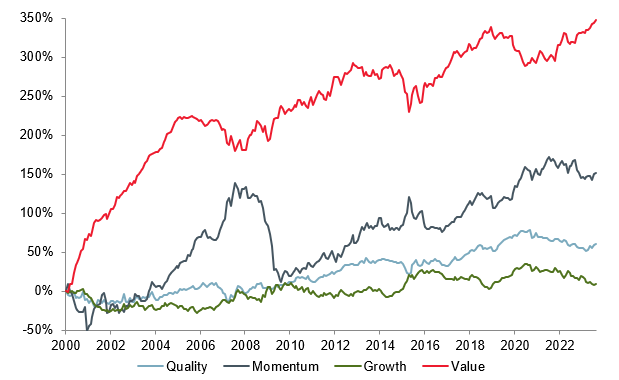

Bihani: Value has outperformed other investing styles in the long term in both Asia (as shown in below charts) and globally. There has been phases of value underperformance like the recent 2017-2021 driven by exceptionally low interest rates and inflation, along with low hard-assets investments. We find many of these trends reversing on interest rates and inflation, and hard-assets investment is rising with supply chain diversification and decarbonization capital investments. These trends are supportive of value investing in Asia.

IPE D.A.CH: Can you briefly describe the bottom-up Investment process for your strategies?

Bihani: The Equity Team employs a disciplined bottom-up fundamental investment approach anchored around valuation. Market prices do not always reflect underlying value; they tend to over-shoot and under-shoot. Assets become mis-priced when investors are willing to pay a high price for ‘comfort’ and to be associated with success, whilst they sell ‘unfashionable’ securities regardless of value. These behavioural biases are systematic and can be exploited by disciplined, long-term investors like us. Our Asia strategies build a portfolio around high conviction stocks where there is a significant dislocation between price and valuation. Our focus on the best potential ideas allows the team to fully invest its collective efforts on what matters most: identifying high conviction valuation outliers that generate alpha.

IPE D.A.CH: How does your ESG-approach works and do you see big awareness amongst Asian companies for ESG related topics?

Bihani: We apply a holistic approach to identifying all material risks, including ESG issues, to determine normalized earnings for a company. An assessment of ESG issues is important in understanding sustainable earnings and may incorporate risks associated with a company’s ‘social agency’ and ongoing franchise. In acknowledging the importance of ESG issues and given they may not have been a central focus in financial markets historically, we have made the assessment of ESG factors explicit for the benefit of our investment process. ESG policy is still evolving in our markets and the focus has shifted over the years from concerns about worker and product safety to other ESG issues, such as changing societal expectations, impacts of disruptive technologies, changing demographics, scarcity of water and other resources, climate change and post financial-crisis executive pay. We utilize internal and external resources in assessing any material risks that arise from ESG issues; we engage with companies in which we invest; and we vote proxies on all resolutions, except where it is not in our client’s best interests.

IPE D.A.CH: If we split ESG in the three factors Environmental, Social and Governance, where would you see the focus, if any?

Bihani: ESG issues and their potential impact differ across companies and are incorporated into our fundamental analysis and decision-making process when we believe they could have a material impact on a company’s valuation and long-term sustainability. We believe our focused, valuation-driven approach is clearly aligned with stewardship activities, including ongoing company engagement, for shareholder value realisation over the longer-term. Asian markets include both developed and emerging economies, and the focus for our ESG research varies depending upon the individual company’s business and ESG policies.

IPE D.A.CH: Can you give our readers an example of a typical portfolio company?

Bihani: The portfolios owns Indusind Bank, the fourth largest private bank in India, with a presence in Vehicle Finance, Retail, Microfinance (MFI), Corporate and SME sector. The bank saw a big derating as a result of loss in management credibility on asset quality, covid lockdowns and management change. The Bank has an excellent liability franchise and is growing its CASA liabilities well. Unlike other lenders, IIB has differentiated underwriting capabilities, whether be in MFI, Vehicle Finance, jewelry etc. The management has changed, and the new CEO is trying to build credibility through transparent communication and better risk management. As the management team builds up credibility, the asset quality concerns ease from the economic recovery from Covid and the bank demonstrates good growth through its differentiated lending book, we expect not only the Book Value of IIB to compound in high teens, but also the P/B multiple to re-rate from its current low level of 1.5x.

IPE D.A.CH: How do you manage risk?

Bihani: Risk control and review forms the disciplined and ongoing feedback mechanism necessary for the portfolio construction process. Risk is overseen at 3 layers in the firm – portfolio management team, Quantitative Solutions and Analytics (QPS) Team, and an independent Investment Risk Management Team. Where a stock approaches its valuation target, the valuation and the position will be reviewed. If there is new information justifying a change in valuation, the position may be maintained. If not, the position will be reduced or sold. In this way, the link from research to portfolio construction and ongoing review is maintained. It, in turn, enables a high degree of transparency around the team’s buy and sell discipline and facilitates the robust peer review process which is essential to the investment approach. The team uses sophisticated, front office portfolio management, order management and investment compliance tools to monitor risk.

IPE D.A.CH: What is your outlook for the Asian equity markets 2024 in general?

Bihani: 2024 will bring about multiple transitions. Some of the global economy’s earlier resilience will give way as the full effect of restrictive monetary policy kicks in. In contrast, the Chinese economy will likely stabilise in 2024, having endured slower growth for most of 2023. Global central banks are likely to be at or close to the end of their rate hiking cycles as inflation pressures ease, although they would be wary of declaring victory over price rises too quickly. As for equities, while Asia ex Japan lagged the US market in 2023, the region is expected to perform better on the back of attractive valuations and more favourable economic fundamentals in 2024. Beyond the cyclical shifts, the global economy and investing landscape will experience long-term structural transitions. The diversification of global supply chains will impact economic prospects and investment flows, while Generative Artificial Intelligence (AI) will disrupt business models and sectors. As economies continue their transition to a net-zero future, investors are increasingly applying a just transition lens onto climate action.

IPE D.A.CH: What are the long-term-drivers for Asian markets?

Bihani: Drivers include urbanization, demographic changes (aging population, smaller families), digitalization and manufacturing wins from China+1. Further, the strong economic growth and rising job opportunities have created a rapidly growing middle class in Asia consequently driving higher consumption per capita growth.

IPE D.A.CH: Any particular points – macro or micro – that keep you awake at night?

Bihani: As active managers with a bottom-up fundamental investment approach, we expect the main source of value add to be via stock selection and, thus, stock-specific risk dominates portfolio characteristics. We sleep well at night, confident in our investment process, stock selection discipline and risk management.

IPE D.A.CH: Many thanks for these insights.

“The Chinese economy will likely stabilise in 2024”

Sundeep Bihani